Our Services

Awesome Accont Managements For Your Business

25 Years Of Experience In Accounting and Taxation Support

It's a critical aspect of business success because it focuses on building strong customer relationships that lead to loyalty, advocacy, and, ultimately, long-term revenue.

Book-Keeping

Tax Saving

Final Accounts

Read More

Easiest filing,no notices, no penalty..

Effortlessly generate Form 16s and file TDS returns. Detect and use unconsumed challans. Effortlessly generate Form 16s and file TDS/GST returns.

Advance Taxes

TDS/TCS Returns

GST Returns

Read More

Assess and evaluate the financial records

Examination of tax returns and financial records to ensure compliance with tax laws and identify potential areas for optimization.Comprehensive examination of financial records during mergers, acquisitions, or business transactions to assess risks and opportunities.

Income Tax Audit

GSTR9 and 9C

GST Audits

Read More

Encompass everything from registration and return filing

We ensure that your business remains GST-compliant at all times, providing clarity and guidance on intricate GST laws and procedures. Along with PAN/TAN services for running your life smoothly.

New GST Registration

Instant/New PAN/TAN Application

PAN Corrections

Read More

Get business documents signed in a matter of minutes

Our services helps an Aadhaar holder to digitally sign their documents anywhere & anytime. .

DSCs Class 1, 2 and 3

Digital Signature Certificate

Encrypt/Signature/Organization DSCs

Read MoreCore Accounting & Financial Services

1. Increasing Growth Potential of Your Business

2. Bookkeeping - Recording day-to-day financial transactions.

3. Accounts Payable & Receivable Management - Tracking and Managing Money.

4. General Ledger Maintenance - Updating and reconciling the general ledger.

5. Reconciliation - Matching internal records with Bank and Vendor Statements.

6. Balance Sheet & Profit and Loss Statement

7. Cash Flow Statements

8. Custom Financial Reports for Management

9. Tax Withholding & Compliance

10.Tax & GST Audit Support

Taxation & Compliance

1. Tax Return Filing (e.g., GST, Income Tax & TDS)

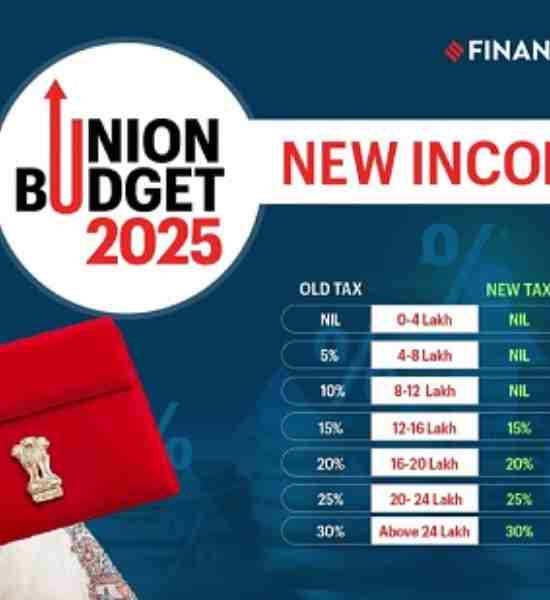

2. ITR Filing (Salaried / Freelancer / NRI)

3. Capital Gains Tax Calculation on sale of property, shares, mutual funds, etc.

4. Income Tax Refund Tracking

5. Form 16/26AS Review

6. Business ITR Filing for partnership firms, LLPs, companies, trusts, etc.

7. Advance Tax Calculating and scheduling advance tax payments.

8. Tax Audit Support (u/s 44AB)

Inventory & Asset Management

1. Fixed Asset Register Maintenance

2. Depreciation Calculation

3. Inventory and Stock Valuation

GST (Goods and Services Tax) Services

1. GST Registration - Assistance with new GST registration for individuals, firms, or companies.

2. GST Return Filing - GSTR-1, GSTR-3B, GSTR-9, etc.

3. GST Reconciliation - Matching purchase data with GSTR-2A/2B to claim accurate input tax credit (ITC).

4. GST Advisory & Compliance - Guidance on GST applicability, tax rates, and classification.

5. Input Tax Credit (ITC) Management - Tracking eligible input credit and ensuring accurate claims.

6. GST Audit Support - Assisting in audits conducted under Section 65/66 or departmental scrutiny.

7. E-Way Bill & E-Invoice Generation Support - Help in generating required documents for transport and large transactions.

PAN & TAN Services

1. New PAN & TAN Application - For individuals, firms, companies, NRIs, etc.

2. PAN & TAN Correction/Update - Changes in name, address, or other details.

3. Linking PAN with Aadhaar - Compliance with mandatory PAN-Aadhaar linking rules.

4. TDS Return Filing - Filing of quarterly TDS returns (Form 24Q, 26Q, 27Q, etc.)

5. TDS/TCS Compliance & Calculation - Ensuring correct deduction rates and timely payments.

6. TDS Certificate Generation - Form 16/16A issuance for employees or vendors.

Software & System Support

1. Implementation of Accounting Software (e.g., Tally Prime, Busy, Quick Book, SoftTrade, Marg)

2. Automation of Accounting Processes

3. Data Migration & Integration